(Static versions of all charts are at the bottom.)

Things That Inflate

Over the past 100 years, the average inflation rate in the US has been somewhere around 3.4% and the country has had a relatively stable year-to-year inflation. The Consumer Price Index (known as the CPI), which was created by the Bureau of Labor Statistics, is the most widely used measure of inflation.

The CPI is like a shopping basket that represents things people usually buy, including groceries, rent, and gas. The price of the basket is tracked and allows economists to come up with a statistical measurement of inflation.

Not everything tracks well with inflation. For example, in the early 2000s, a 32” flatscreen TV might cost $1000 or more, but thanks to advancements in technology, this same size TV is significantly cheaper (and way better). This post is about some other things with interesting histories and trends compared to inflation.

Higher Ed

It’s no shock that college is way more expensive today than a few decades ago. But the difference is so shocking that it’s difficult to even understand the relationship between the first 50 years of inflation compared to Harvard’s tuition in the below chart because of the price change.

In the year 1900, Harvard’s tuition was $150. If the tuition would have tracked with inflation, that same $150 would be the equivalent of around $5,000. Harvard’s tuition, however, is more than 10x that amount. (If your family makes less than $85k, however, tuition is now free.) Harvard’s tuition increase is, unfortunately, the norm rather than the exception. Throw in the cost of required [and frequently unnecessary] textbooks, housing, and fees and the actual cost of college could be up to 50% more than tuition itself. Yikes.

Buying a Home

House prices are actually factored into the CPI, but historically the cost of a home has outpaced inflation rates. This means you have to make more and spend a lot more of your income on a home than you would have had to 60 years ago (adjusted for inflation). Or even 3 years ago.

In 1963, the average home prices was around $18k. If that trend would have tracked with inflation, the average home price today would be around $185k. Unfortunately for anybody looking to buy a home now, the average home price is $425k which is a number that is a lot higher than $185k. There has been a rare dip in housing prices (rare when comparing it to any period within the last 60 years) with average home cost coming down 7% from the post-pandemic highs of 2022. That probably doesn’t make most people feel too, good, though, as home prices have increased an average of about $100k in the past 5 years. Oof.

Pianos

The Steinway Model D is the flagship concert grand piano made by Steinway. They have been making this piano since 1884. The company still makes some of the finest pianos in the world that end up in homes, schools, and concert halls worldwide. Steinway has also become a luxury brand with a certain sense of elitism like that of a high-fashioned purse or an exotic sports car. But you can buy a lot of purses for the price of a single Model D.

Keeping in mind that there are many factors that go into pricing goods (see the technology example above, price of materials, labor costs, etc.), the Steinway Model D has seen an explosion in price with the MSRP of a new piano easily doubling in the last 20 years and almost quadrupling in the past 40. The top of the line Model D isn’t on an island by itself when comparing to the world’s other top pianos, but the price increase is staggering. Buying used will probably save you $100k or more.

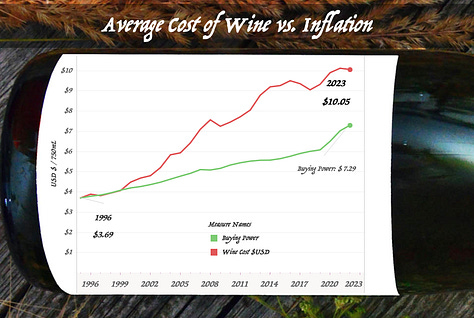

It’s Okay to Wine

The Russian invasion of Ukraine caused glass prices to rise. Consumption of wine also increased during the COVID-19 pandemic. In the grand scheme of things, though, we’re just glad that the cost of wine isn’t following the Harvard Tuition Trend.

Admittedly, the numbers seem rather low for the average cost of 750mL of wine—a standard wine bottle size. (See below for data sources.) It seems as though the cost of wine is trending lower than inflation at least in the past handful of years. Since the process of making the wine can involve a few years of growing and fermenting grapes, I would expect the downward dip of wine prices not to be a continuing trend. But I play piano for a living so don’t put too much stock in that.

McDonald’s Cheeseburger

I can’t be the only one annoyed that price of McDonald’s has increased substantially in the past few years. Cheeseburgers were only $0.19 when the first restaurant opened in 1940 (without cheese the burger was only $0.15). The cost of a cheeseburger now (this does fluctuate a little based on location) is $2.29.

When looked at in the long run, though, the price of a cheeseburger has stayed lower than inflation. If that original cheeseburger in 1940 kept up with inflation, by 2024, that delicacy would be $4.32. And to be even more fair, using the McDonald’s app saves you at least 20% on your order, so the actual price is lower than that above. So even though the price of a cheeseburger has gone up significantly since 2020, it’s still a good deal in the long run. Plus, apparently you can actually buy and hold a cheeseburger for 20 years without worrying it will deteriorate.

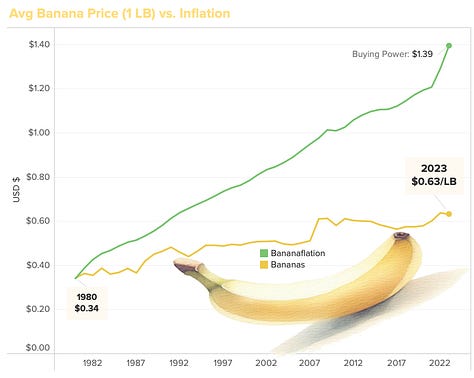

BananaFlation

Not everything gets way more expensive over time, as you can see with McDonald’s. One of the best examples of this is the banana. Although the data below only goes back to 1980 (this single data source didn’t require me to hunt through magazine ads from the 1920s to gather pricing data), the banana is significantly cheaper than it was compared to almost any time period. One blogger makes the argument that they are actually 20x cheaper than they were a century ago.

If tracked just back to 1980 (this commodity has been a staple for 150 years in the US), the price tracks way under inflation. A pound of bananas tracking with inflation would cost $1.39/lb, but instead, they still only cost on average $0.63/lb. It turns out that bananas are the most common fruit on planet Earth and much time, energy, and technology has been spent to make them readily available which helps explain the above graphic. Most people just buy bananas to keep in a fruit dish before throwing them out 10 days later when they turn black, but that’s okay, because they don’t cost that much money.

Sources

The bananas, house sales, and wine data came from FRED, the Federal Reserve Economic Data data.

The Harvard tuition data came from the University itself and historical news articles.

The Steinway data set came from Steinway.

The McDonald’s data came from a smattering of newspapers, menus, and pictures of the drive-through taken on somebody’s disposable Kodak camera.